Dear Reader,

This is a follow-up post comparing the New Tax Regime FY 2023-24 with

the Old Regime. In my previous post on this topic, I had given a quick view on

the key changes in the new tax regime as announced in Budget 2023. In case you

haven’t read it, you may read it here.

In this post, I have tried to give you a broad decision making framework

to help you choose an appropriate Tax Regime, based on your income and the tax

saving investments/deductions you are likely to avail in FY 2023-24. The

analysis has been done largely from a salaried individual’s perspective.

For the purpose of this analysis, I have taken into consideration

various income ranges and their tax implications under either regime. Further,

for each range, I have highlighted the threshold point / level of tax saving investments

/ deductions required to bring the two regimes on par with each other in terms

of the overall tax outgo. Your choice of tax regime depends on whether the total

tax saving investments / deductions you are eligible for or likely to avail in

F.Y. 2023-24 falls below or above this threshold level.

Note: The taxable Income for the purpose of this

analysis, is assumed to have been arrived at after adjusting for common deductions

such as standard deduction and other common non-taxable components in the

salary if any. This way, the differences in pay structures among individual tax

payers are appropriately accounted for and thus we make way for a fair

comparison. Nevertheless, you should treat this piece of writing as my personal

opinion only and take the advice of a Qualified Tax Professional to arrive at a

final decision w.r.t your tax planning choices.

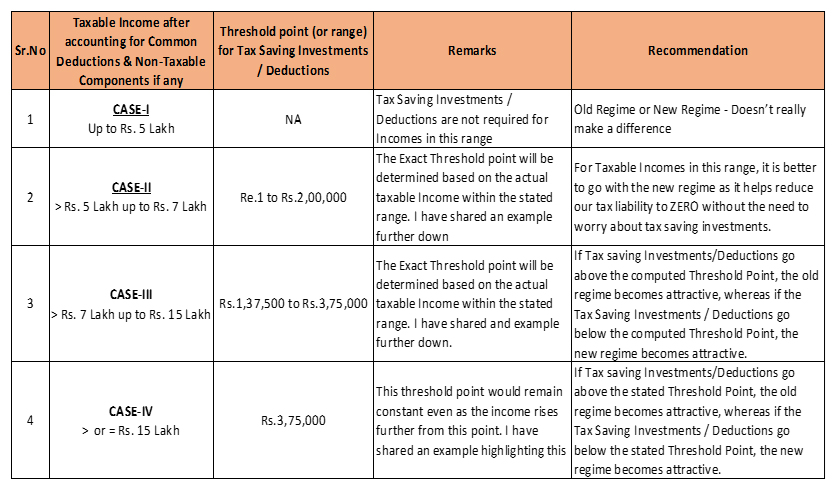

Before I get into the details, I would like to give you a quick summary

of my recommendations. Hope, this serves as a ready reference.

Summary of Recommendations:

To help you get an in-depth understanding of these four cases, I have

elaborated each one of them giving illustrations and appropriate rationale

wherever required.

CASE-I: If

the Taxable Salary is up to Rs.5 Lakh:

Both regimes get the benefit of rebate u/s 87A to varying degrees i.e.

New Regime – up to Rs.7 Lakh and Old Regime – up to Rs.5 Lakh. In this case

since the Taxable Income considered after the common adjustments is up to Rs.5

Lakh, the individual will be exempt from paying taxes under either regime. Thus, old or new, doesn’t make a

difference for individuals in this income range.

CASE-II: If

the Taxable Salary is > Rs.5 Lakh up to Rs.7 Lakh:

Threshold Level for Tax Saving Investments/Deductions:

Re.1/- to Rs.2 Lakh depending on whether your taxable income falls

in the lower end of the range or in the higher end.

ILLUSTRATION-I:

Taxable Income after Accounting for Common Adjustments = Rs.5.25 Lakh

§ Tax

Liability under New Regime = Nil

§ Tax

Liability under Old Regime (without deductions) = Rs.17,500

§ Tax

Liability under Old Regime (with tax saving deductions worth Rs.25,000) = Nil

Thus, Minimum Tax Saving Investments/Deductions

required in this case to bring the tax liability under the old Regime at par

with that in the New Regime = Rs.25,000

ILLUSTRATION-II:

Taxable Income after Accounting for Common Adjustments = Rs.6.75 Lakh

§ Tax

Liability under New Regime = Nil

§ Tax

Liability under Old Regime (without deductions) = Rs.47,500

§ Tax

Liability under Old Regime (with tax saving deductions worth Rs.1,75,000) = Nil

Thus, minimum Tax Saving Investments/Deductions

required in this case to bring the tax liability in the old Regime at par with

the New Regime = Rs.1,75,000

Conclusion: For Taxable Incomes in this range, the old

regime, at best, can only match the new regime, but cannot beat it, as the new

regime enjoys a higher rebate u/s 87A (i.e. for incomes up to Rs.7 Lakh)

thereby reducing the tax liability in the New Regime to Nil. Hence for Taxable

Incomes in this range, it makes sense to choose the New Regime over the Old

one, to enjoy the benefit of zero taxes in a hassle free manner.

CASE-III:

If the Taxable Salary is > Rs.7 Lakh up to Rs.15 Lakh:

Threshold Level for Tax Saving

Investments/Deductions: Rs.1,37,500

to Rs.3,75,000

Depending on whether the Taxable Income Falls in the Lower end of the Income Range (>

Rs.7 Lakh up to Rs.15 Lakh) or the Higher

end, an appropriate Threshold Number within the range will be applicable. Here

are a couple of Illustrations to help you understand this:

ILLUSTRATION-I:

Taxable Income after Accounting for Common Adjustments = Rs.7.50 Lakh

§ Tax

Liability under New Regime = Rs.30,000

§ Tax

Liability under Old Regime (without deductions) = Rs.62,500

§ Tax

Liability under Old Regime (with tax saving deductions worth Rs.1,62,500) =

Rs.30,000

Thus, the threshold level for Tax

Saving Investments/Deductions required in this case to bring the tax liability

in the old Regime at par with the New Regime = Rs.1,62,500. Anything above this

level will make the old regime attractive, while anything below will make the

new regime attractive.

Note: In this case, if the individual manages to

avail tax saving investments/deductions worth Rs.2,50,000 the net taxable

income gets pushed to Rs.5 Lakh thus bringing the tax liability to zero under

the old regime. Thus for incomes in the lower end of this range (> Rs.7 Lakh up to Rs.15 Lakh),

one should assess the possibility of maximizing the total deductions so that

the net taxable income is pushed to under Rs.5 Lakh.

ILLUSTRATION-II:

Taxable Income after Accounting for Common Adjustments = Rs.13.50 Lakh

§ Tax

Liability under New Regime = Rs.1,20,000

§ Tax

Liability under Old Regime (without deductions) = Rs.2,17,500

§ Tax

Liability under Old Regime (with tax saving deductions worth Rs.3,25,000) = Rs.1,20,000

Thus, the threshold level for Tax

Saving Investments/Deductions required in this case to bring the tax liability

in the old Regime at par with the New Regime = Rs.3,25,000. Anything above this

level will make the old regime attractive, while anything below will make the

new regime attractive.

CASE-IV:

If the Taxable Salary is greater than or equal to Rs.15 Lakh:

Threshold Point for Tax Saving

Investments/Deductions for Taxable Incomes of Rs.15 Lakh or more = Rs. 3,75,000

ILLUSTRATION-I:

Taxable Income after Accounting for Common Adjustments = Rs.15 Lakh

§ Tax

Liability under New Regime = Rs.1,50,000

§ Tax

Liability under Old Regime (without deductions) = Rs.2,62,500

§ Tax

Liability under Old Regime (with tax saving deductions worth Rs.3,75,000) =

Rs.1,50,000

Thus, the threshold level for Tax

Saving Investments/Deductions required in this case to bring the tax liability

in the old Regime at par with the New Regime = Rs.3,75,000. Anything above this

level will make the old regime attractive, while anything below will make the

new regime attractive.

ILLUSTRATION-II:

Taxable Income after Accounting for Common Adjustments = Rs.18 Lakh

§ Tax

Liability under New Regime = Rs.2,40,000

§ Tax

Liability under Old Regime (without deductions) = Rs.3,52,500

§ Tax

Liability under Old Regime (with tax saving deductions worth Rs.3,75,000) =

Rs.2,40,000

Thus, the threshold level for Tax

Saving Investments/Deductions required in this case to bring the tax liability

in the old Regime at par with the New Regime = Rs.3,75,000. Anything above this

level will make the old regime attractive, while anything below will make the

new regime attractive.

As seen in the above two

illustrations, in case of Taxable Incomes of Rs.15 Lakh or above, the Threshold

Level for Tax Saving Investments/Deductions remains constant even as the income

rises further to much higher levels.

Note: For the purpose of this analysis, I have only considered

salaried individuals with annual income below Rs.50 Lakh. The tax computations

in the various illustrations shown above do not include cess.

CONCLUSION:

If the Tax Saving Investments /

Deductions likely to be availed for the Financial Year 2023-24, crosses the

threshold level as illustrated above, the Old Regime becomes attractive,

whereas if they go below the stated level. the advantage shifts to the New

Regime.